Homeowners Insurance and Water Damage Coverage

4/20/2021 (Permalink)

Insurance coverage can be confusing at times. That's why our team at SERVPRO of Chesterfield and Tri-Cities, Plus wants you to get the facts before you have water damage issues and no insight on what's covered by insurance.

Does Homeowners Insurance Cover Water Damage?

Yes - most homeowners insurance policies help to cover the damage only if it's a sudden or accidental cause.

There are basically two types of coverage depending on what has been damaged:

Dwelling Coverage - helps to pay for structural damage, such as a pipe burst and water damages the walls.

Personal Property Coverage - helps to pay for damage to your belongings, such as a pipe bursts and affects your furniture or electronics.

What's Not Covered by Insurance?

- Replacing/Repairing Source of Water Damage

- Water Backup from outside drain or sewer

- Unresolved maintenance issues

- Floods - you need a separate flood insurance policy

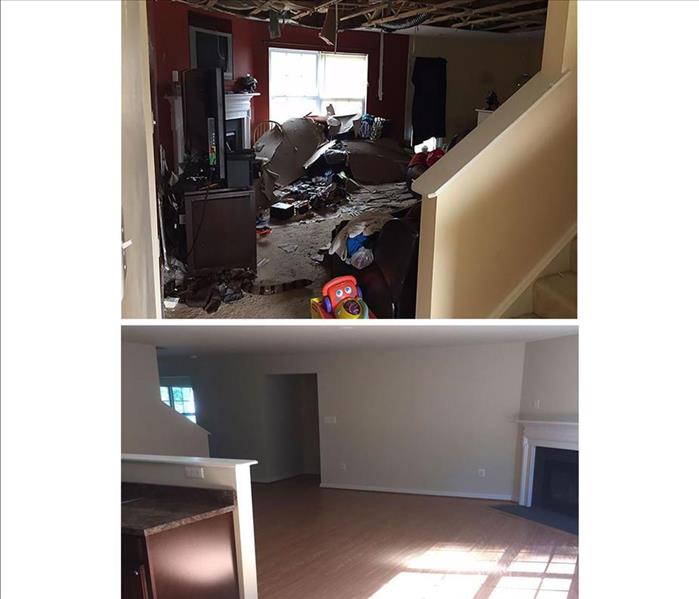

If you experience water damage in your home or business, our SERVPRO professionals will work with your insurance to efficiently and effectively restore your home.

24/7 Emergency Service

24/7 Emergency Service